Get estate planning on the agenda

PAUL BRENT SPECIAL TO THE GLOBE AND MAIL PUBLISHED NOVEMBER 7, 2019 Estate planning can present the greatest set of challenges for financial advisors. Doing it right means helping clients confront their mortality, employ an array of financial strategies and […]The dangers of reverse mortgages

Jason Abbott, president of WEALTHdesigns.ca, joins BNN’s House Money to talk about the dangers of reverse mortgages and other options Canadians can turn to. Please click here to watch video…Annuities gain appeal as interest rates rise

MARJO JOHNE SPECIAL TO THE GLOBE AND MAIL PUBLISHED MAY 17, 2018 Moshe Milevsky drew heat from readers two years ago after he wrote an article in the Wall Street Journal about buying a US$5,000 annuity at age 42. It […]Renting versus owning a home in hot housing markets

Jason Abbott, president of WEALTHdesigns.ca, joins BNN to offer advice for those who are considering making the jump from renting to owning a home, and how that advice could change if you’re in an overheated housing market. Please click here […]Diversification – The big blind spot that business owners face

CHRIS ATCHISON Special to The Globe and Mail Published Thursday, Apr. 06, 2017 5:10PM EDT Last updated Thursday, Apr. 06, 2017 5:10PM EDT Business owners are a unique breed. They take financial risks to launch companies that, statistically, have little […]Kids’ activity on the Web puts parents at financial risk

PAUL ATTFIELD The Globe and Mail Published Friday, Oct. 07, 2016 5:00AM EDT Last updated Wednesday, Oct. 05, 2016 4:10PM EDT On New Year’s Day, 1965, children’s television host Soupy Sales asked viewers to remove those “funny green pieces of […]Should you borrow to invest? Globe and Mail

KIRA VERMOND Special to The Globe and Mail Published Thursday, Oct. 01, 2015 5:00AM EDTRetirement Date Funds Globe and Mail

Retirement-date funds: Smart no-brainer or investor cop-out? Please click here to watch video… KIRA VERMOND Special to The Globe and Mail Last updated Thursday, May. 08 2014, 9:44 AM EDT The concept is simple enough. Invest in a fund, leave […]Low interest rates prompt savers to borrow to invest CBC News

Kevin Stone plans to borrow $20K this year to invest in various stocks By Aleksandra Sagan, Posted: Aug 04, 2015 5:00 AM ET Last Updated: Aug 04, 2015 5:00 AM ET Kevin Stone is 28 years old and already has over […]Universal Child Care Benefit CTV News

Certified financial planner Jason Abbott of WEALTHdesigns.ca discusses the Universal Child Care Benefit (UCCB) with CTV News’ Amanda Blitz. Please click here to watch video…RRSP overcontributors deserve our sympathy (no, really)

KIRA VERMOND Special to The Globe and Mail Last updated Friday, Feb. 13 2015, 5:15 AM EST Not long ago, a potential client walked through Jason Abbott’s door with a conundrum. What should she do about a sizable overcontribution […]The Top 5 Downsizing Mistakes Good Times Magazine

Wendy Haaf, April 2016 Almost every homeowner will ponder the great existential question at some point: to downsize or not to downsize? Whether ‘tis wider to sell the house you’ve been living in for years and move to a […]Is RRSP season counter-productive to proper saving?

DAVID FRIEND Toronto — The Canadian Press Special to The Globe and Mail Published Friday, Jan. 16 2015, 6:00 AM EST Last updated Thursday, Jan. 15 2015, 4:03 PM EST As the hype around RRSP season ramps up, it’s […]Splitting up RRSPs, other assets during a grey divorce can get messy

by Linda Nguyen, Canadian Press Published on: 13/02/01 Last Updated: 13/02/01 TORONTO — Dividing assets during a divorce can be a complicated and emotional process, especially for seniors who may not have planned on spending retirement alone. Financial experts say like […]You need time, money or expertise to own rental property

DARAH HANSEN Special to The Globe and Mail Published Tuesday, Sep. 09 2014, 5:00 AM EDT Last updated Monday, Sep. 08 2014, 1:34 PM EDT It was more accident than intention that led Anni Jansson to buy her first investment […]How to lower bank fees CTV News

Jason Abbott of WEALTHdesigns.ca discusses ways in which consumers can find ways to reduce fees and save money. Please click here to watch video…Five things people forget when planning for retirement

KIRA VERMOND Special to The Globe and Mail Published Tuesday, Jan. 21 2014, 4:54 PM While it’s true no one can anticipate every one of life’s bumps in the road, creating a retirement plan is better than nothing when […]Plan ahead: the key to staying comfortable in your old age

By: Kristin Kent Published on Fri Jun 28 2013 Renya Onasick knows the challenges of caregiving. As a parent, an involved daughter and long-distance caregiver of her mother, Onasick is engaged in all family matters. This involvement comes with a […]Hey, retirement-saving procrastinators: You’re not 20 anymore

by KIRA VERMOND Special to The Globe and Mail Published Jun. 24, 2013 Finishing grad school, buying that first home and deciding to have children. They’re not the only life goals some Canadians put off. Add the words “saving for […]In a stagnant economy, should you hunker down and take fewer risks?

by Kira Vermond Special to The Globe and Mail Published Tuesday, Feb. 05 2013 Last updated Tuesday, Feb. 05 2013 How do you spell “meh?” Take a high unemployment rate and tack it onto low GDP growth, rock-bottom interest rates and nary […]Credit card smarts for students

by Sharon Aschaiek Published on 10/25/2012 Students must educate themselves to avoid big debt problems A student’s first credit card can be a real high — until they encounter the low of crushing debt. A recent report by TransUnion Canada shows […]Slap your hand if it dips into the RRSP jar

KIRA VERMOND Special to The Globe and Mail Published Monday, Jan. 27 2014, 4:47 PM At a time when some Canadians are gearing up to contribute to their Registered Retirement Savings Plan (RRSP) before the March 3 deadline, others are […]Financial resolutions that you can keep

by Angela Self Special to The Globe and Mail Published Thursday, Dec. 15 2011 Last updated Monday, Sep. 10 2012 Our New Year’s resolutions tend to focus on health and wealth. And while it’s easy to jot them down and share them […]Advisor comes out swinging

Jason Abbott has been training hard for the third version of the Brawl on Bay Street By Gavin Adamson Published on Nov 2008 A little wooziness might be common for the average advisor these days, but Jason Abbott admits his […]Advisor takes beating for cause

Interview of Jason Abbott Jason Abbott, a certified financial planner and the owner of WealthDesigns.ca Inc., describes his practice, his specialization in disability benefits, and Bay Street Brawl III, a charity event on Nov. 6 in Toronto for which he’s […]Getting divorced? Five steps to get your finances back on track

by Angela Self Special to The Globe and Mail Published Thursday, Nov. 30 2002. Last updated Wednesday, May. 16 2012. Rhonda Cochrane’s world was blown apart when her partner ended their relationship. “I was devastated,” says the forty-something Abbotsford, B.C. woman. Despite […]Payback time for student debt

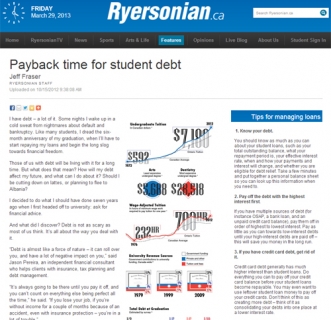

by Jeff Fraser, RYERSONIAN STAFF Published on 10/15/2012 I have debt – a lot of it. Some nights I wake up in a cold sweat from nightmares about default and bankruptcy. Like many students, I dread the six-month anniversary of my […]Business owner clients need coverage

Policies can be used to replace income or to fund shareholders’ agreements, depending on the business By Gavin Adamson Published on Nov 2008 Small-business owners are often too busy running their businesses to think about insuring them. But advisors who […]What to Consider Before Taking From Your RRSP

by Martha Worboy We all have desires: a vacation in the sun, a bigger house or simply some wine for the weekend. No matter what it is you want, it may take more money than your income […]The new appeal of life and disability insurance

Clients worried about markets are realizing that insurance can help provide capital preservation By Gavin Adamson Published on March 2009 Clients’ financial in-security during the recession could make them more receptive to buying insurance products. “The insurance opportunity today is […]To Close a Credit Card or Not? The Risks of Closing a Card

by Martha Worboy If you’re feeling tied down by credit card debt you’re not alone. A recent Harris/Decima survey reports that nearly half of Canadians “always or often” carry balances on their cards, and one-in-20 aren’t sure they will ever […]